Homeowners Insurance in and around Colorado Springs

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

New home. New adventures. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help cover your home in case of hailstorm or windstorm, but it can also be beneficial in specific legal situations. If someone were to hold you financially accountable if they tripped at your residence, the right homeowners insurance may be able to cover the cost.

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Safeguard Your Greatest Asset

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Kevin Fawcett can be there whenever the unexpected happens, to get your homelife back to normal. State Farm is there for you.

There's nothing better than a clean house and insurance with State Farm that is dependable and reliable. Make sure your valuables are insured by contacting Kevin Fawcett today!

Have More Questions About Homeowners Insurance?

Call Kevin at (719) 445-0226 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

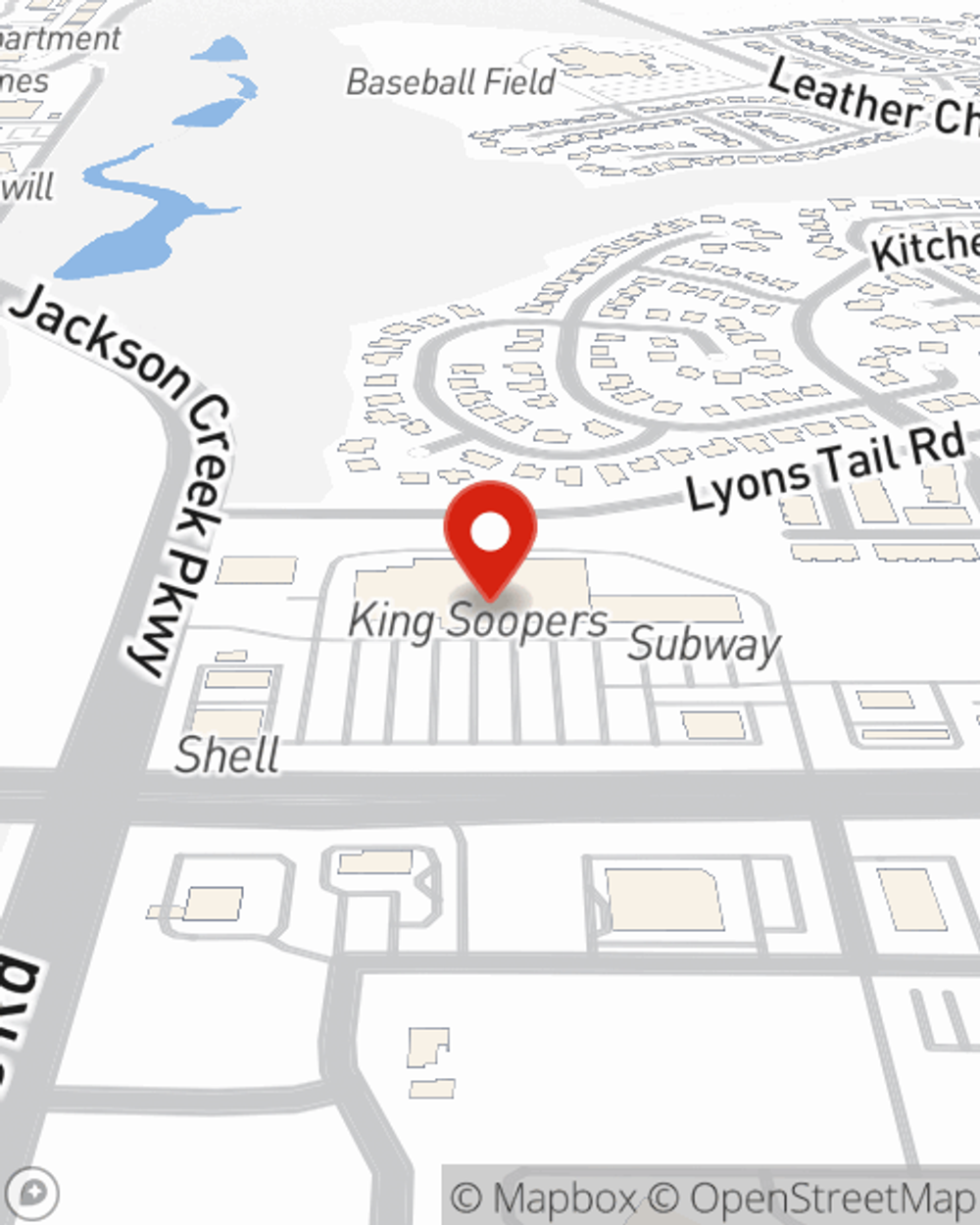

Kevin Fawcett

State Farm® Insurance AgentSimple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.